This interactive process map will provide details on the activities and interactions you will have with EMRS as a licenced electricity Supplier to support you in participating in the CfD scheme for EMR. When you click on each stage this will provide you with the requirements applicable for your role, tasks to be completed and relevant supporting information.

- 1Registering with EMRS

- 2Aggregation Rules

- 3Credit Cover

- 4First Daily Invoice

- 5Reserve Payment

- 6Quarterly Reconciliation

- 7Operational Cost Refund

1. Registering with EMRS

All licensed electricity Suppliers are required to register with EMRS using My EMRS. This is a digital solution removing the completion of manual forms and provides you with access to your registration details you have provided.

A new Supplier will receive a ‘Welcome Email’ from EMRS to initiate the Registration process with us. WP21- Supplier Registration details the process steps for a new registration.

We have produced a short video to illustrate the Registration process using My EMRS.

For additional support or guidance, we have published G25 – My EMRS User Guide and About My EMRS contains useful FAQs.

You will need to complete the following registration details within My EMRS:

- Registration User

- Company Details

- Settlement Information

- Primary Bank Account

- Credit Cover Return Account

- Contact Details

Once these details are completed, you submit them for Approval by an Authorised Contact and then EMRS. We will keep you informed via email notification of successfully or unsuccessfully approval and when to access My EMRS if required.

Amending Registration Details

You are able to amend your registration details at any time via using My EMRS and this is also detailed in WP21- Supplier Registration. To amend your details please select ‘Party Details‘ and ‘Amend Registration‘ from the Action drop down on the right-hand side on the screen. You can then select from the menu on the left-hand side on the area you wish to amend:

- User Contact Details

- Company Details

- Settlement Information

- Primary Bank Account

- Credit Cover Return Account

- Contact Details

To understand the privileges against each Authorised Contact please do read through G4 – EMR and Nuclear RAB Settlement Authorisations.

Primary Authority, Finance Authority, Operating Authority and Trading Contacts can submit amendments to registrations details via My EMRS. All amendments will be required to be approved by either a Finance Authority or a Primary Party Authority (this cannot be the same person who has submitted the amendment. This expands on the current external approval for amendments to Bank Account detail and reduces the risk of erroneous activity within My EMRS.

Once approved externally, these will be received by EMRS to review and confirm if your updates have been approved or rejected by email.

Please note when Bank Account Details are amended these do need to be verified and EMRS will contact a relevant Authorised Contact (either a Primary Party Authority or a Finance Authority) to confirm bank details.

2. Aggregation Rules

We create EMR Aggregation Rules for each Supplier to ensure that each Supplier is charged for their correct volume. Before metered data can be used to calculate Supplier payments, it must be aggregated by the EMR Settlement System using the EMR Aggregation Rules. It’s important the Aggregation Rules are correct as the basis for EMR charges.

For the Contracts for Difference (CfD), the type of demand used within the EMR Aggregation Rules is Gross Demand. EMRS first creates a Supplier’s EMR Aggregation Rules when we are notified by Elexon that BM Units have been created for them.

EMRS will send Suppliers a copy of their EMR Aggregation Rules when they’re created and when any subsequent updates are made. WP25 – Aggregation Rules provides further details.

3. Credit Cover

It is the responsibility of Suppliers to lodge and maintain sufficient valid Credit Cover to meet their Credit Cover requirement on each day during the relevant Quarterly Obligation Period. This is to ensure that Low Carbon Contracts Company (LCCC) is holding sufficient Credit Cover on any day it is required.

What is the process for lodging Credit Cover?

WP42 – Supplier CfD and Nuclear RAB Credit Cover provides details on the process for lodging Credit Cover including the Letter of Credit templates (from p20) and the approved bank account details for cash Credit Cover (p6).

In order for Credit Cover to be considered valid:

- Cash amount must have been received in the relevant bank account; and

- Valid Letter of Credit received electronically.

PLEASE NOTE:

- The bank account details and Letter of Credit templates are different to those used for Capacity Market Credit Cover.

- When any changes are required to existing Letter of Credits that are in place, Suppliers are recommended to issue an amendment to a Letter of Credit rather than issuing a new Letter of Credit.

How is my Credit Cover requirement calculated?

As a minimum, a sufficient level is equivalent to the last 21 days of Gross Demand (excluding EII exempted electricity) multiplied by the Interim Levy Rate in force on the day for which the calculation is being performed . G5 – Supplier CfD Credit Cover provides information on how to calculate your Credit Cover, the daily Credit Cover Report and what happens if a Supplier doesn’t lodge sufficient Credit Cover.

What is my current CfD Credit Cover balance?

The CfD Credit Cover balance can be found in the latest Daily Credit Cover Report (D0363) sent to your company email. Please see item J2022 (Column H) on the report which reflects the Total Credit Cover (combination of cash and Letter of Credit value) held as of the day.

Data Transfer Catalogue (DTC) provides further details of the other data items within the Daily Credit Cover Report (D0363). The DTC is available on Electralink website.

Where can I find the Interim Levy Rates?

Settlement Data webpage provides the Key Payment Figures which provides the Interim Levy Rate for the Quarterly Obligation Period to support the Credit Cover calculation. The CfD Scheme Dashboards provides the determined Interim Levy Rates by LCCC and a 15 month forecast.

4. First Daily Invoice

All Suppliers are required to fund the Contracts for Difference (CfD) arrangements through the Supplier Obligation. The CfD scheme is designed to incentivise investment in low carbon generation by offering difference payments to CfD Generators.

The two payments are:

- Operational Cost Payment is a daily charge to cover the operating costs of the CfD Counterparty for the coming Financial Year in performing its function to administer the CfD scheme. The Operational Costs Levy is recovered via the Operational Costs Levy Rate, which is a pound per megawatt hour (£/MWh) amount charged to Suppliers based on Daily Gross Demand.

- Interim Rate Payment charge covers expected payments to CfD Generators in a quarter and is recovered via the Interim Rate Levy which is a pound per megawatt (£/MWh) amount charged to Suppliers based on Daily Gross Demand. These financial quarters are referred to as Quarterly Obligation Periods. The invoice for the Interim Rate Payment is generated two Working Days after the relevant BSC Settlement Run (seven Working Days for II, 18 Working Days for SF, and 36 to 40 Working Days for R1), to allow for data collection and calculations to be performed. The charge is shown as a line on the Daily Supplier Invoice, which must be paid within five Working Days.

G2 – Calculation of Supplier Demand provides Suppliers with information about the data and the calculations that are used for EMR charging.

There is also information on:

- the approach of how sites are treated for CfD charging; and

- how the Transmission Loss Multiplier is applied in the charging methodologies for both CfD.

G16 – Supplier CfD and Nuclear RAB Payments give Suppliers information on what the Capacity Market payments are for, how they are calculated and when to expect the associated invoices or credit notes.

Key Figures for Payments sets out the main rates and amounts used in the calculation of payments under both the Contracts for Difference (CfD) and Capacity Market (CM) schemes.

EMRS Settlement Calendar provides a schedule of when payments for Suppliers will be invoiced, when payment is due, and if applicable, the Settlement Date and the Settlement Run.

The CfD Scheme Dashboards provides the determined Interim Levy Rates by LCCC and a 15 month forecast.

5. Reserve Payment

Reserve Payments cover the risk that payments to CfD Generators are higher than forecast or electricity demand is lower than forecast, and ensure there is no shortfall between payments in from Suppliers and out to CfD Generators.

The LCCC will determine and publish the Total Reserve Amount using the CfD Scheme Dashboards.

EMRS will apportion the Total Reserve Amount amongst Suppliers according to each Supplier’s market share. A Supplier’s market share is calculated using metered data provided by the Balancing and Settlement Code Company (BSCCo). The Reference Period is the 30 calendar days for which there is metered data (excluding Interim Information data) prior to the date on which the Total Reserve Amount is determined by the LCCC.

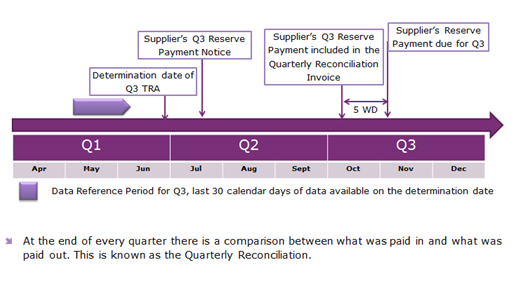

The activities involved in terms of the Total Reserve Amount and the Supplier’s Reserve Payment are as follows:

- no later than the last Working Day of an Quarterly Obligation Period LCCC determine the Total Reserve Amount

- Eighth WD of the Quarterly Obligation Period preceding the relevant Quarterly Obligation Period that Suppliers receive a notice to inform them of their share of the Total Reserve Amount

- Quarterly Reconciliation Invoice also acts as the invoice for the Supplier’s Reserve Payment

- Invoice Issued on the eighth WD of the relevant Quarterly Obligation Period

- Covers any reconciliation payments due back to Suppliers

- Payment is due five WDs from the invoice date

These steps are illustrated below:

G3 – CfD and Nuclear RAB Reserve Payment this guidance note will give Suppliers information on how these Reserve Payments are calculated and reconciled.

6. Quarterly Reconciliation

The Interim Rate Payment and the Reserve Payments are reconciled at the end of a quarter as CfD Generator payments have been made and by this time more accurate metered data is available.

To calculate what a Supplier should have actually paid over the quarter, or their CfD Period Contribution, we will aggregate the CfD Daily Contribution and the CfD Quarterly Contribution. To calculate the CfD Daily Contribution for each Supplier we will multiply Net Generator Payments by their Supplier’s daily market share. Market share will be based on a Supplier’s daily metered volumes. This is done for each day within a quarter.

While Net Generator Payments are the primary form of payments to CfD Generators, there is a possibility that CfD Generators could be paid lump sum amounts. These lump sum amounts will be aggregated and apportioned amongst Suppliers according to their metered volumes over the quarter. As this is done on a quarterly basis, these payments are called CfD Quarterly Contribution.

Once the CfD Period Contribution is calculated we will compare the CfD Period Contribution, what a Supplier should have paid, to the payments made under the Interim Rate Levy, or what a Supplier did pay. The difference between the two is then compared against the Quarterly Reserve Payment to give the Supplier’s reconciliation payment.

Reconciliation payments for previous Quarterly Obligation Periods will be taken into account if more accurate metered data is available. The reconciliation payment will then be compared to the most recently notified Reserve Payment.

Further information is available in the following documents:

G3 – CfD and Nuclear RAB Reserve Payment this guidance note will give Suppliers information on how these Reserve Payments are calculated and reconciled.

G16 – Supplier CfD and Nuclear RAB Payments give Suppliers information on what the Capacity Market payments are for, how they are calculated and when to expect the associated invoices or credit notes.

EMRS Settlement Calendar provides a schedule of when payments for Suppliers will be invoiced, when payment is due, and if applicable, the Settlement Date and the Settlement Run.

7. Operational Cost Refund

Operational Costs are forecasted in advance, once the actual costs for running the Contract for Difference (CfD) scheme are determined for a Financial Year, the difference will be split between Suppliers dependant on market share. EMRS will notify Supplier on LCCC behalf if a refund is due to occur.